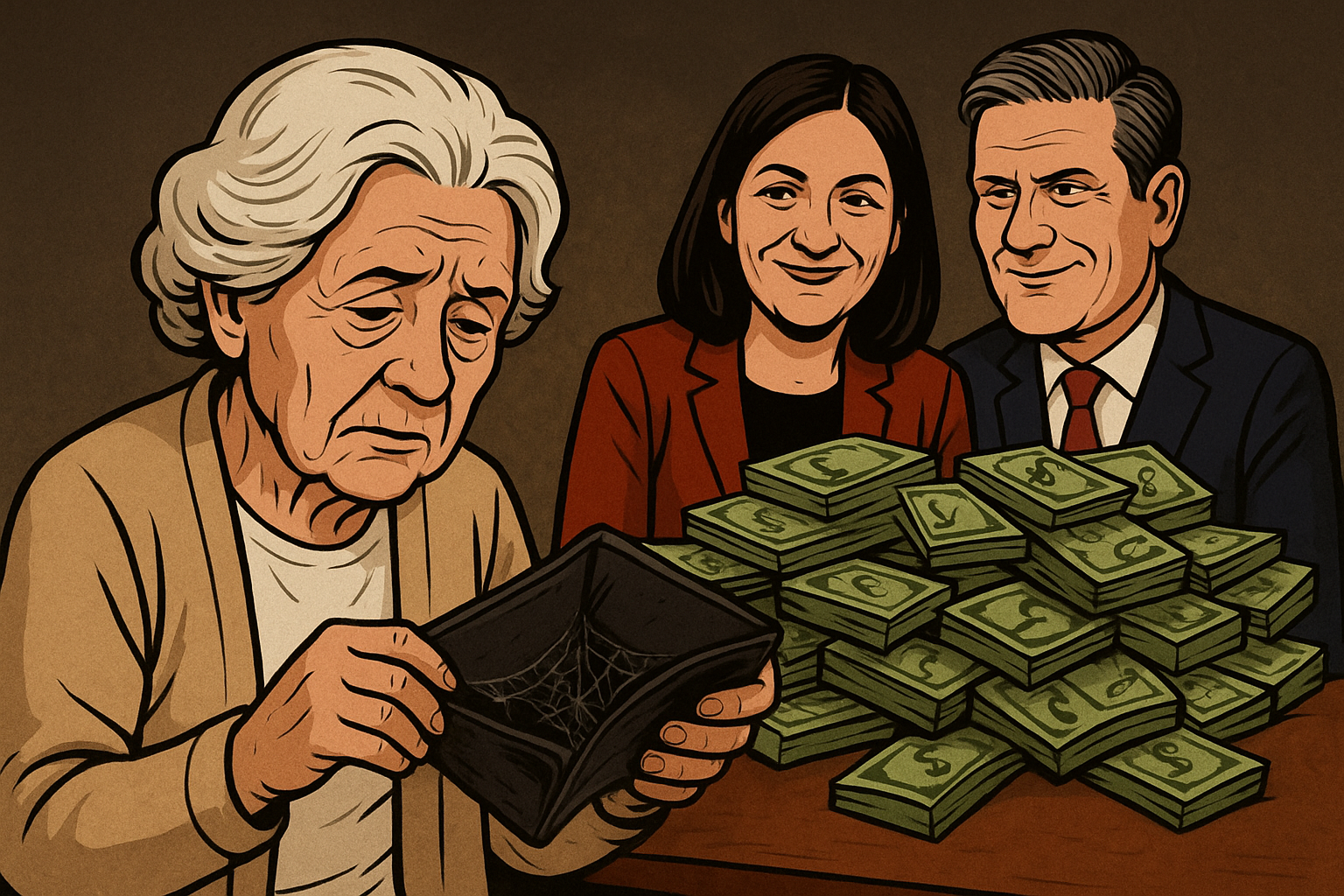

Labour’s Stealth Tax: Food Prices Surge as Families Pay the Price

Kier Starmer promised he would not raise taxes for the working people, instead he went after employers and small businesses instead with the full knowledge that any cost increases for them would translate to higher costs for the working people, therefore, we are subject to a stealth tax which we can’t avoid because we need food to survive.

Food price inflation has jumped yet again, climbing to 5.1% in August, the sharpest rise since early last year, with beef, butter, milk and even chocolate seeing double-digit hikes. While the Bank of England’s headline inflation rate sits stubbornly at 3.8%, the weekly shop is where families are feeling the real squeeze.

And this is where Labour’s rhetoric falls apart. For years, the party has sold itself as the defender of “working people”, promising to ease the cost-of-living crisis and deliver stability. Yet, under their watch, the basics of everyday life have become more expensive, not less. It’s no good Rachel Reeves standing at the despatch box pledging to “support families” when her own policies are fuelling the very price rises that are pushing those families to breaking point or forcing businesses under, like family farms, who have found operating their business is no longer sustainable with the new family farm tax.

By targeting businesses with higher National Insurance and wage costs and other tax burdens, Labour hoped to look tough without touching ordinary earners directly. But this trick doesn’t work in the real world. Businesses don’t absorb those costs out of goodwill, they pass them on. As a result all of us face inflated prices at the tills, pay packets stretch less each month, and the promise of “making work pay” rings hollow because we’re paying so much in stealth taxes, employers can’t afford pay rises in line with inflation and whilst everything goes up, our wages stay the same.

Labour’s approach amounts to a political sleight of hand. They avoid the headlines that would come with directly hiking income tax or VAT, but in practice, families are paying more every week simply to put food on the table as a direct result of taxes levied against business. It’s a stealth tax dressed up as fairness, and it flies in the face of everything they claimed they stood for.

The harsh truth is that if you’re working hard, doing your best, and trying to make ends meet then Labour hasn’t made your life easier, it has made it more expensive. The people they promised to protect are the very people now carrying the heaviest burden.

Supermarkets and suppliers are pointing to the obvious fact that higher National Insurance Contributions for employers and an enforced minimum wage hike are behind price rises and stagnated wages. Both were proudly trumpeted by Chancellor Rachel Reeves as proof Labour were “taxing businesses, not working people”. The reality? Businesses simply added the increased costs to their prices leaving shoppers footing the bill.

This is the quiet genius of Labour’s approach. Supporters of Labour will say we aren’t being taxed directly and therefore, that’s OK bu instead of taxing individuals directly, they slap taxes and costs on employers, who then pass it down the chain until it lands squarely in the pockets of ordinary families like you and me.

The Office for National Statistics confirmed Britain is now an “outlier” in Europe, with inflation significantly higher than France (0.8%) and Germany (2.1%). Economists say the difference is being driven “largely by domestic policy choices”, namely Reeves’ NIC rise. In other words, it’s not global pressures, it’s Westminster decisions that’s making us poor.

Staple foods are soaring with beef up nearly 25%, butter up 19%, chocolate 15%, milk over 12%. Wages may have risen 4.7%, but food costs are rising faster still. Families are falling behind, no matter how Labour tries to spin it.

Small businesses aren’t immune either. Tom Egan, who runs Coosh Bakery in Nottingham, said butter and chocolate prices have shot up alongside his National Insurance bill, forcing him to pull back on investment. That means less productivity, higher costs, and ultimately, even higher prices for the public.

Reeves claims she “won’t be coming back with more borrowing or more taxes” but that’s exactly what these measures are: hidden taxes dressed up as business levies. The effect is the same as hiking income tax or VAT, except it comes without the honesty of admitting it.

Labour promised to protect “working people”, yet through stealth taxation, it’s those very people who are now paying more at the checkout, more on their bills, and more for everyday essentials.

The government isn’t taxing business, it’s taxing you and we have to show our resentment for how Labour is mismanaging the economy all whilst top players in the cabinet are attempting to defraud the public by failing to pay the correct tax.

All eyes now turn to Rachel Reeves’ November Budget – the real “moment of truth”. Will she admit that Labour’s tax-and-spend experiment has failed? Or will she double down on a policy that punishes the very people she promised to protect? If the first Budget was the set-up, the second will be the verdict. Families across Britain will be watching closely, and if the Chancellor thinks she can keep tightening the screw while hiding behind spin, she may be in for a shock.

But this isn’t something we have to take lying down. We can stand up to Labour’s stealth tax in three ways:

- Expose the reality by calling out the narrative that these are “business taxes”. Businesses don’t pay them, families do, through the higher cost of living we face as businesses increase costs to maintain their ability to continue trading in light of the massive tax grab.

- Hold MPs accountable by writing to your local representatives, challenge them on why their party’s policies are driving up the cost of living, and demand straight answers.

- Support transparency and choice by backing campaigns and businesses that highlight the real cost of Labour’s economic policy, rather than quietly passing it on.

The truth is that every hidden levy, every rise in National Insurance, every so-called “business tax” ends up as another pound taken from the pockets of our pockets, the ordinary working people. And the only way to stop it is to shine a light on it, speak out, and refuse to accept the idea that this is the “new normal”.

Labour came to power promising relief, fairness and stability. What we’ve got instead is a stealth tax that’s making life harder for families across Britain. That’s not just a betrayal, it’s a con.

If Labour were serious about making life easier for working people, it would not be leaning on stealth taxes that quietly erode family budgets each week at the supermarket. The decision to raise employer National Insurance Contributions and increase the minimum wage in one swoop may have been framed as a way to make business pay its “fair share”, yet in reality it has done nothing more than inflate the cost of food and essentials. It isn’t like Labour were not already aware or made aware of the consequences of taxing businesses. Businesses do not absorb those extra costs out of charity. They adjust, they calculate, and ultimately they pass those costs on to the public; private companies have a legal duty to shareholders to maintain profitability, they have no choice. Families are left paying more while hearing the same tired speeches from ministers about fairness and stability. People’s Insight have compiled a handy inexhaustive list of things we are all paying more for:

- Food: up 5.1% overall, with staples like beef (+25%), butter (+19%), chocolate (+15%) and milk (+12%) leading the surge

- Rent: at record highs across the UK, with average monthly rents climbing well above wage growth

- Energy: still elevated despite government pledges, with gas and electricity bills swallowing a bigger share of household income

- Mortgage repayments: rising as interest rates remain stubborn, leaving homeowners trapped with higher monthly costs

- Insurance: car, home and business insurance premiums all spiking, with some families facing double-digit percentage increases year on year

- Council tax: creeping up across local authorities, adding yet another burden to already stretched households – we also understand that the increased costs councils face as a result of the same stealth tax we face are forcing council tax up, therefore meaning we are being taxed twice and at the same time, more councils across the country are declaring financial emergencies.

- Fuel: petrol and diesel prices climbing again, pushing up transport costs for families and businesses alike

- Public transport: rail and bus fares increasing well above inflation, making commuting more expensive

- Household goods: furniture, appliances and other essentials more costly due to supply chain pressures and higher import costs

- Hair and beauty services

- Cafes, restaurants and pubs

- Communications including mobile and broadband.

There are alternatives that Labour could have chosen had it truly wished to live up to its promises. Instead of raising taxes on work and pushing up costs at the till, the government could have looked at reducing the hidden levies that make employing people more expensive. That would have encouraged growth, strengthened wages naturally and stopped the steady rise in food prices that has now become the new normal. Labour could also have taken a serious look at its own spending. Every year billions are wasted through bloated bureaucracy, failed contracts and questionable international spending commitments, money that could easily be redirected towards easing pressure at home without touching the pockets of working families.

Britain’s weak food security is another area where real change could have been delivered. Farmers and producers here face constant hurdles in the form of regulation and cost burdens, leaving us reliant on imports and vulnerable to global shocks. By supporting domestic production, Labour could have ensured that staples remained affordable while strengthening resilience across the supply chain. Instead, those same farmers are seeing their costs rise in tandem with the bakers, shopkeepers and supermarkets who now have no choice but to raise prices.

Small businesses in particular have been hung out to dry. They are the backbone of communities, yet instead of being supported they have been hit with higher contributions and wage bills, forcing many to scale back investment and productivity. That harms not only the businesses themselves but also the very people Labour claims to champion, because weaker businesses mean weaker competition and inevitably higher costs for the customer.

What Britain needed was a government willing to take inflation seriously and work in step with the Bank of England to bring it back under control. That would have required fiscal discipline, restraint and a recognition that reckless new spending commitments only feed the problem. Instead, we are left with political sleight of hand. Labour insists it is protecting working people, yet every trip to the supermarket tells a different story. Prices are climbing faster than wages, family budgets are being stretched to breaking point and the promise of relief has been replaced by disappointment.

If Labour truly wanted to ease the cost of living, it would have tackled the root causes of rising prices rather than disguising new taxes as “fairness”. It would have cut waste, supported growth and backed British producers. It would have helped small businesses to thrive instead of treating them as cash machines. Most of all, it would have remembered that every tax, whether levied directly on individuals or indirectly through business, ultimately falls on the same shoulders. Those shoulders belong to ordinary families who are now paying more for everything from bread to butter. Far from delivering stability, Labour’s choices have made life harder, and until those choices change, no speech or slogan will alter the reality at the checkout.

Labour promised to make life easier for working people, yet every policy decision so far has had the opposite effect. By piling new costs onto businesses through higher National Insurance and wage bills, the government has created a stealth tax that filters straight through to the public in the form of higher prices. Food inflation at 5.1% is not just a statistic, it is families struggling at the checkout as beef, butter, milk and chocolate climb out of reach. It is rent at record levels, mortgage repayments rising, insurance premiums soaring, and council tax creeping higher, all while wages fail to keep up.

This is not the relief or stability that was promised. It is a cost of living crisis born not out of global forces beyond our control, but out of deliberate domestic policy choices. Every so-called business tax is in reality a tax on ordinary families, and until that truth is recognised, nothing will change.

As we approach Rachel Reeves’ November Budget, the question is simple: will Labour admit its mistakes and ease the burden on households, or will it double down on the failed approach that has left Britain an outlier in Europe on inflation? Working people cannot afford more stealth taxes hidden behind political spin.

Britain needs policies that cut waste, support small businesses, back domestic food production and bring inflation under control. What it does not need is more broken promises and hidden costs disguised as fairness. If Labour truly wants to deliver for working people, it must change course now, because every day it delays, the weekly shop gets more expensive and the pressure on families grows.

The stealth taxes are not just hitting businesses, they are hitting you, your family, your grand parents, siblings and children. They are hitting every single one of us. The only way forward is to hold Labour accountable and demand policies that genuinely make life easier, not harder.