Labour Tax Grab Is Strangling Economy

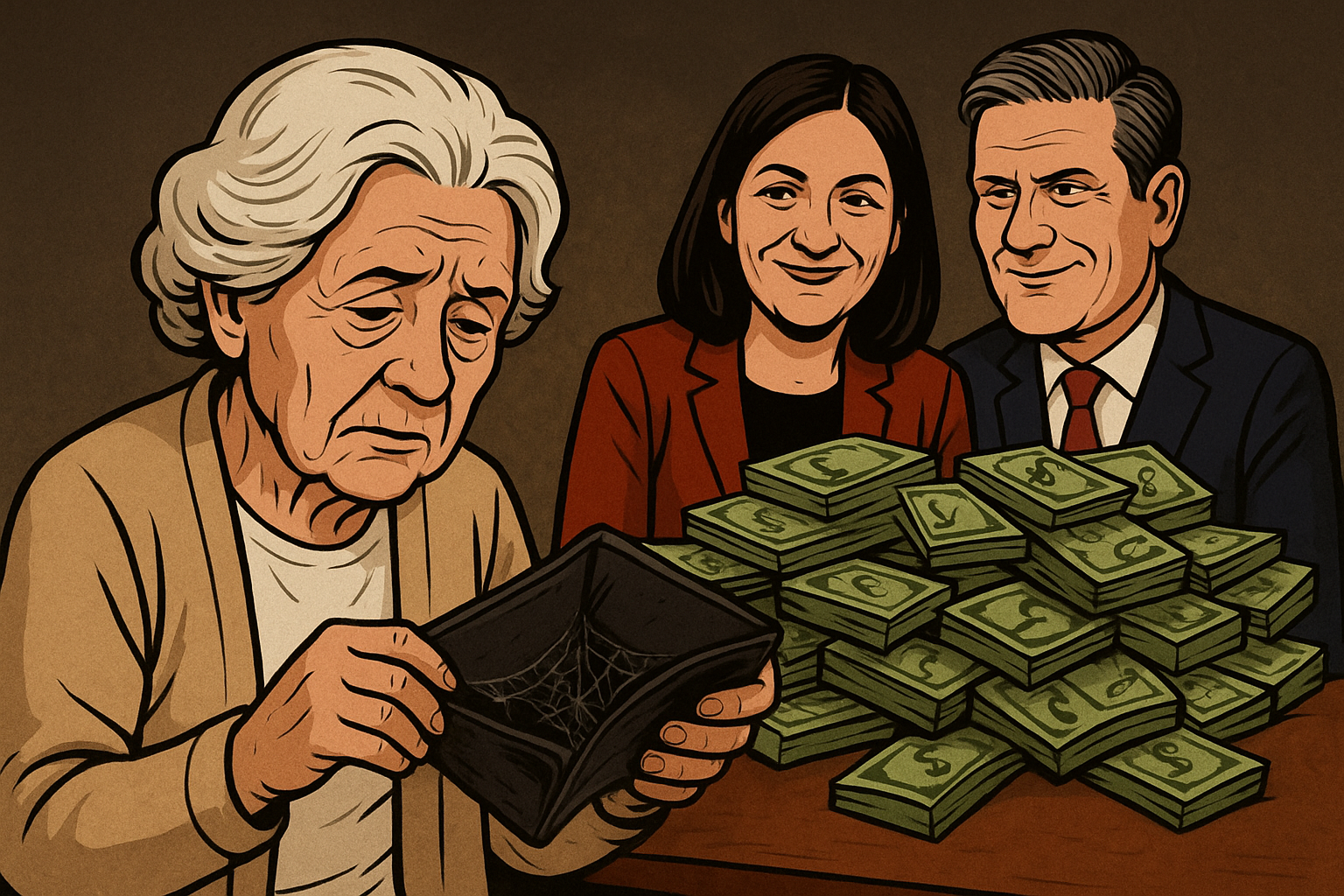

Britain’s job market is stalling and it is not a coincidence. New reports show that employment has slumped harder here than anywhere else in Europe, with businesses rocked by a £40 billion tax raid that was meant to plug holes in the Treasury but has instead driven confidence into the ground and opened chasms of further economic burden. Employers are pulling back, jobseekers are multiplying and the knock-on effect for ordinary people is obvious, with less opportunity, less stability, and less prosperity. This is a direct consequence of Rachel Reeves’ repeated tax grabs burdened by the British public.

At the heart of this decline lies Labour’s appetite for taxation. The increases to employer National Insurance contributions alone have piled billions onto wage bills, leaving firms with a difficult choice: cut back on hiring, reduce hours, or pass the costs onto customers already grappling with soaring prices. People’s Insight has been made aware of numerous employees who have lost their jobs because employers simply cannot afford to keep them and other employers who are thinking very carefully about whether to hire to fill roles or increase the responsibilities of their current staff adding to their workloads. Added to this is the Apprenticeship Levy, which was sold as an investment in skills but has become a bureaucratic drain, tying up funds in schemes that do not meet the real needs of small and medium-sized employers. Rather than creating a pipeline of talent, it has forced many to scale back training altogether meaning fewer young people have access to the same opportunities that were available before Labour’s flagship tax drain.

The squeeze does not stop there. Labour’s so-called family farm tax reforms have left agricultural businesses gasping for air, some farmers have even committed suicide as a result of the financial pressure they face, a lasting legacy Starmer and his cabinet must shoulder for the rest of their lives. By altering inheritance tax reliefs and tightening capital allowances, family-run farms, already wrestling with rising fuel and fertiliser costs, now face crippling bills just to keep their operations afloat. Recruitment of seasonal and permanent labour in agriculture has become near impossible, with many farms opting to downsize or mechanise instead of hiring, taking jobs away from British people and reducing the British labour force. This is a direct assault on the rural economy that starves younger generations of opportunities in industries that once sustained communities and kills industries our country have been built off the back of.

Hospitality and retail, two sectors that rely heavily on flexible staffing, have been battered by increases in business rates and VAT burdens, compounded by higher employer National Insurance. Restaurants, bars, and high-street shops are shutting their doors not because demand has vanished, but because government has made employing people and the overall cost of living unaffordable. Every shuttered pub or closed café represents not just a loss of jobs but also the erosion of local life, sacrificed on the altar of Labour’s cash-grab economics. Every job lost is a notch in the bed post of political failures.

Construction has managed to hold on but only just, industry growth is fragile. New housing developments and infrastructure projects are being delayed or cancelled as firms face punitive taxes on materials, transport, and payroll. Labour talks about solving the housing crisis, yet its policies have made it more expensive to employ the very bricklayers, electricians, and engineers needed to build homes. Recruitment in this sector is faltering despite Britain’s urgent need for more housing. Similarly, the Renters Reform Act is set to send rents spiralling up making housing even more inaccessible for lower income renters.

The irony is glaring. Labour dresses up these tax hikes as progressive measures to fund public services and to improve the economy but the opposite has prevailed, instead they choke the very engine that drives those revenues, the private sector. Employers bear the brunt, but it is workers and communities who ultimately pay the price. Less investment, fewer jobs, stagnant wages, and an economy that grows weaker by the day.

The rot begins with employer National Insurance. This is nothing more than a tax on jobs. Every time a business hires someone, it pays an extra percentage of that worker’s wage directly to the Treasury. Labour’s increase has turned each new hire into a financial burden. A small café in Leicester that wanted to take on two more staff for the breakfast rush has shelved its plans because the additional cost makes the maths impossible. Multiply that story across the country and you see why the queues at Jobcentres are growing.

Then there is the Apprenticeship Levy. Marketed as an investment in skills, it has become a bureaucratic nightmare. A manufacturing firm in Birmingham pays tens of thousands into the scheme each year yet cannot use it to train the welders it desperately needs, because the rules are too rigid. The money sits in Whitehall while the company cuts back on recruitment. Instead of creating apprenticeships, the levy has curtailed them.

The so-called family farm tax is another hammer blow. By tightening inheritance tax reliefs and limiting capital allowances, Labour has left family-run farms facing bills that threaten their very survival. A dairy farm in Yorkshire that has been passed down for generations is now considering selling off land simply to pay the taxman. Recruitment of seasonal workers has collapsed because the family can no longer risk the outlay when every spare penny is needed to keep the farm afloat. This is not just an economic issue, it is cultural vandalism against rural life.

Business rates are draining the high street dry. A small clothing shop in Nottingham pays more in rates than it does in rent after you deduct the licensing costs and taxes passed on to tenants as part of the rent they pay, while online giants pay nothing like the same burden. Faced with this, shops either close down or operate on a skeleton staff. Every boarded-up window represents lost jobs, lost training opportunities and lost community spirit, this is Labour’s legacy.

Hospitality has been hit with a double punch, higher VAT and higher National Insurance. A pub in the South West now pays more in tax on every pint than it earns in profit. The landlord wanted to employ two young people from the local college, but rising VAT has cut margins so thin that those jobs have vanished before they began. LBC Radio recently had a guest on who explained the pub trade is dying and that Britain used to have one pub per 150 people in the UK but today, we have one pub per 1500 people.

Construction firms are in the same bind. Labour talks about tackling the housing shortage, yet builders are being crippled by fuel duty, material levies, and payroll taxes. A mid-sized firm in London recently pulled out of a housing development because the cost of materials and labour, inflated by Labour’s tax regime, made the project unviable. That decision alone cost dozens of bricklayers and electricians months of secure work.

Taken together, these taxes form a pattern. They are not designed to encourage growth, they are designed to squeeze every last penny out if mine and your pocket. They punish employers for creating jobs, and in turn they punish the public who depend on those jobs. Labour dresses this up as fairness, but the reality is less investment, fewer hires, stagnant wages, weaker communities and less money in our pocket with generations ahead of us expected to pay the debts our government borrow uncontrollably.

This is not responsible governance, it is economic vandalism. Labour has taxed Britain into decline, creating a vicious cycle where higher levies mean fewer jobs, fewer jobs mean less growth, and less growth is used as the excuse for another round of raids on the private sector and so the vicious cycle continues until the house of cards collapses. It is living proof that when you punish employers with endless taxes, it is not businesses that truly suffer, it is the ordinary people who are denied the chance of opportunity and prosperity.

This is not positive economic management, it is a deliberate act of sabotage against the nation’s prosperity. Britain is being taxed into decline, with Labour presiding over a vicious cycle where higher levies lead to fewer hires, fewer hires lead to weaker growth, and weaker growth is then used as justification for yet another tax raid on employers and the general public. It is the clearest evidence that punishing businesses never builds a stronger economy, it only drags down the very public who depend on wages, training, and opportunity.

What we are witnessing is a hollowing-out of Britain’s productive base. Instead of encouraging employers to invest, expand, and create the conditions for upward mobility, Labour has chosen to strip capital out of the private sector and funnel it into the Treasury’s black hole. It is the politics of short-term revenue over long-term growth, and it leaves communities poorer, industries cautious, and young people locked out of the labour market.

The tragedy is that our country has the skills, ambition, and entrepreneurial drive to thrive, yet government policy has chained that potential with layer upon layer of taxation. From farms and workshops to construction sites and high streets, investment is being stifled and recruitment frozen. A nation cannot grow if every incentive to employ and innovate is penalised. Labour’s obsession with tax hikes is not just undermining the economy today, it is eroding the foundations of tomorrow’s prosperity.

Before Labour’s tax-grab budget, 41% of firms said they planned to hire while only 13% foresaw cutbacks. Now that margin has collapsed to just 11 percentage points. That is a 17-point nosedive in recruitment confidence, the sharpest fall among all 21 European countries surveyed. France dipped by 8 points, Germany by just 5, yet Britain, under Labour’s economic stewardship, has taken the hardest hit. It is a textbook case of how punishing employers with higher payroll costs does not raise growth, it strangles it.

This collapse in confidence is not an abstract figure on a spreadsheet, it is a direct hit on everyday life. A small manufacturer in the Midlands who had plans to expand his factory floor has mothballed the project, leaving dozens of skilled machinists without the jobs they were promised. A chain of hairdressers in Manchester has frozen its apprentice intake, meaning local school leavers looking for a first step into work now face rejection instead of opportunity. Families relying on seasonal agricultural jobs in East Anglia are finding fewer positions available, as farmers weigh the tax burden against already rising input costs and decide to hire fewer hands.

The consequences ripple through communities. In towns where retail once offered reliable employment, higher business rates and payroll taxes mean fewer shops are willing to take on weekend staff and every day, small independent businesses are shuttering for good. Teenagers who would have learned the basics of work through a Saturday job are being left without that entry point, while households that depend on extra income are forced to go without. In construction, firms are shelving housing projects, which not only means fewer jobs for bricklayers and electricians, it also means fewer homes for families desperate to get on the property ladder, increased house prices in response to low supply and increased rents for the same reason. The public ends up paying twice, once through lost opportunity and again through higher rents and house prices and longer waiting lists.

Hospitality tells the same story. A family-run pub in Cornwall wanted to employ three part-time bar staff over the summer season, but once National Insurance increases and VAT rises were factored in, the plan was scrapped. Instead, the landlord worked longer hours himself and his wife picked up the slack, leaving local students with fewer options for holiday work and the community with less money circulating through its economy. What should have been extra employment for young people became exhaustion for small business owners.

Every example illustrates the same point. When government raises taxes on employers, it is not just a line item in a budget statement, it is a blow to people’s livelihoods. It is the job not created, the apprenticeship not offered, the family-run business that cannot grow, and the housing estate that never gets built. Labour insists these measures are about fairness, but in practice they rob ordinary people of the opportunities they need to build a better life.

The picture on the ground is bleak. Job applications are rising at the fastest rate since the lockdown of 2020, but this is not a sign of a thriving economy. It is a symptom of retreating businesses, it’s a result of job losses caused by redundancies created by unaffordability caused by taxation where employers are forced to curb recruitment as Labour’s tax policies make every new hire more costly. People are not moving into better opportunities; they are jostling for a shrinking pool of available roles, often taking jobs that offer less security, lower pay, or fewer hours than they would have otherwise expected.

Regions like the South East are feeling the squeeze most sharply. From small start-ups in Brighton to family-run manufacturers in Kent, firms are delaying expansions or freezing recruitment entirely, citing the rising costs of National Insurance, payroll levies, and other taxes. Only construction has shown pockets of resilience, largely because of ongoing infrastructure projects and housing demand, but even here growth is fragile and employment gains are modest compared with the scale of opportunity being lost elsewhere.

Retail and hospitality, once pillars of local employment, continue to contract. Shops, cafés, and restaurants close or downsize as rising business rates, VAT, and payroll costs make staying open unaffordable. Weekend shifts and seasonal roles vanish, leaving young people and part-time workers with fewer ways to earn a living. Communities suffer as footfall drops, local economies stagnate, and the very businesses that give towns and cities their character are forced to retreat.

The economy is under siege. Labour’s insistence on squeezing employers has consequences that extend far beyond balance sheets. It hits families, communities, and the next generation of workers. Jobs are not being created; they are being denied, and the public bears the cost.

The impact spreads far beyond the high street. In education, schools and nurseries are struggling to fill roles as rising employer costs force hiring freezes. Teaching assistants, support staff, and administrative positions that would normally provide both employment and critical community support are left vacant. Parents face longer waiting lists for childcare and extra strain juggling work and family responsibilities, while young people miss out on entry-level roles that could have set them on a career path.

Healthcare and social care are similarly affected. Care homes and clinics, already stretched, are forced to limit recruitment because of higher payroll taxes. Nurses, carers, and support staff find fewer openings, meaning patients wait longer for care and workers are overburdened and patient care is declining reducing the quality of life of those who paid into our economy their entire lives. It is you and me who pays for this, first through reduced services, and second through lost opportunities for those who would have entered the sector in meaningful roles.

Logistics and delivery services, vital for both households and the economy, are not immune. Drivers, warehouse operatives, and logistics coordinators are harder to recruit as employers face spiralling costs. Packages take longer to arrive, companies scale back operations, and small independent couriers struggle to compete with large corporations, further narrowing employment prospects in local areas.

Even sectors that might seem resilient, like technology or construction, are feeling the strain. Tech start-ups in cities like London and Manchester postpone hiring developers and engineers because the payroll burden makes scaling unsustainable and those who are actively hiring are hiring freelancers from countries like Philippines and India for less than £8 per hour because it’s the only way the can compete in a landscape where we’re forced to pay the highest tax of most countries in the world. Construction firms delay projects, leaving bricklayers, electricians, and site managers without work, while the nation’s housing and infrastructure targets fall further behind.

Labour’s tax policies have created a domino effect: businesses reduce recruitment, fewer roles are available, communities suffer, and young people face fewer opportunities to enter the workforce. This is not a minor slowdown, it is a structural squeeze that touches every corner of the economy, from urban centres to rural villages. The public experiences it daily as we face shuttered shops, overstretched services, delayed housing, and missed opportunities, while the government celebrates figures that fail to reflect the human cost behind them.

This climate has encouraged what analysts are calling “job hugging”, with younger workers prioritising security over career ambition. Two-thirds of people aged 18 to 34 now say they value stability above progression, while over half report that competition for available roles has become noticeably tougher.

This is not a sign of a healthy, dynamic economy; it is a reflection of widespread caution, fear and anxiety. Individuals are holding on to their current positions because businesses, burdened by higher taxes and payroll costs, are far less willing to take on additional staff and everybody’s job is at risk. Opportunities that would have allowed young people to gain experience, develop skills, and advance their careers are being restricted, leaving a generation forced to settle for security rather than growth and this culture will be inherited for generations to come if urgent action isn’t taken.

The consequences ripple through the workforce and wider society. Entry-level roles in retail, hospitality, and care sectors, which once provided a first step into employment, are now scarce. Graduates looking for their first professional positions face a saturated market where openings are limited and competition intense. Even mid-level professionals are increasingly reluctant to move jobs, aware that firms are hesitant to hire and expansion plans are on hold. What should be a vibrant cycle of opportunity has slowed to a crawl, with ambition dampened and economic mobility restricted.

The fear is not abstract; it has real, tangible effects on communities. Young people delay moving out of the family home, savings stagnate, and local economies feel the strain as spending and investment into new jobs, expansion and the economy slows or even halts entirely. Labour’s approach to taxation has created a culture of caution, where businesses hold back from hiring and individuals hold back from taking the risks necessary for progression. Instead of fostering growth, the policies have fostered hesitation and insecurity across the workforce.

Building directly on the “job hugging” culture, the effects are already feeding back into productivity, wages, and long-term economic prospects. When younger workers cling to security rather than seeking advancement, the talent pipeline slows, innovation stalls, and businesses lose the dynamism they need to grow. Firms that might have expanded or invested in new projects instead tread carefully, constrained by rising employment costs and a workforce that is hesitant to move. The result is a stagnation loop where opportunities are restricted, skills development slows, and the economy as a whole loses momentum.

Wages are affected too. With fewer positions opening up and promotion opportunities limited, employees have less leverage to negotiate higher pay causing them to settle for less, contributing to a low-wage culture. Employers, mindful of higher taxes and levies, are reluctant to increase salaries or offer additional benefits. This creates a squeeze on household incomes, particularly for younger workers trying to get on the property ladder or support families. The financial pressures compound the sense of insecurity, leaving people working harder just to maintain the same standard of living.

The impact on local economies is clear and it’s bad. When job mobility is constrained and wages stagnate, spending slows, and small businesses feel the effect almost immediately. Cafés, shops, and service providers lose customers and may be forced to cut staff or reduce hours themselves, many will go out of business through no fault of their own, we have already seen this with retail staples including Claire’s Jewelers. Communities that rely on a mix of part-time and full-time workers for their vibrancy see less activity, fewer opportunities, and slower economic circulation.

Building on the stagnation and “job hugging” culture, the cumulative effect of Labour’s tax policies can be seen clearly across specific industries, each bearing a heavy human cost.

In retail, small shops and local chains are struggling under rising business rates and payroll costs. Many are freezing recruitment or reducing staff hours, leaving part-time workers and students with fewer opportunities to earn. When a corner shop cannot afford an extra cashier or a boutique cannot hire a shop assistant, it is not just a business decision, it is a lost pathway for young people to gain skills, experience, and independence. Communities feel the pinch too, as footfall falls, high streets stagnate, and local economies slow.

Hospitality faces a similar story. Pubs, cafés, and restaurants, already operating on thin margins, are forced to hold off on hiring additional staff because National Insurance hikes and VAT increases make each new role expensive. Seasonal work, often a first job for teenagers and a supplement for students, is disappearing. A seaside hotel that might have taken on extra staff for the summer now asks existing employees to cover longer shifts, placing strain on workers and reducing opportunities for locals who might have benefitted from temporary employment.

In construction, firms are delaying or cancelling projects due to higher taxes on materials, transport, and payroll. This has a direct effect on employment: bricklayers, electricians, and site managers face uncertainty and reduced opportunities, while the housing crisis remains unresolved. Communities waiting for new homes see projects stall, and workers looking to advance their careers find fewer openings. The cost is both immediate, in lost jobs, and long-term, in delayed infrastructure and housing development.

Agriculture and family-run farms are also feeling the strain. Tax changes on inheritance and capital allowances, coupled with rising input costs, have forced farms to cut back on seasonal and permanent staff. Young people hoping to work in rural industries now find fewer opportunities, while farming families are forced to make difficult decisions about downsizing or mechanisation. The result is fewer jobs, weaker rural economies, and communities struggling to retain younger generations.

Even sectors that appear resilient, like technology and logistics, are constrained. Start-ups delay hiring developers or warehouse staff because payroll taxes make scaling unsustainable. Delivery services and logistics companies are forced to operate with skeleton teams, slowing operations and limiting opportunities for both entry-level and experienced workers.

Across the board, the story is the same: Labour’s tax policies create fewer jobs, fewer opportunities, and less security for workers. The human cost is tangible and students, graduates, young families, and working adults all find themselves squeezed out of positions they might have taken, forced to accept less pay, fewer hours, or even unemployment. Ordinary people bear the burden of a government approach that prioritises revenue extraction over economic growth, and the communities they live in suffer as a result.

Long-term, this pattern threatens to erode Britain’s competitiveness. Labour’s tax-heavy approach discourages risk-taking and entrepreneurship, making the UK a less attractive place for ambitious startups or expanding firms. The workforce becomes risk-averse, opportunities become concentrated, and economic growth flattens. Instead of fostering an economy that encourages talent, enterprise, and innovation, the policies have created a system where caution dominates, ambition is stifled, and ordinary people are left to bear the cost.

At the root of this collapse lies Labour’s fixation with taxing its way to growth which has been proven to be a fallacy time and time again, not just in Britain with previous Labour governments but worldwide, countries that adopt hard socialist policies face hyperinflation and civil war. The Chancellor’s increases in employer National Insurance, alongside a raft of other hikes, have not only eroded business confidence but also reduced the very opportunities people rely on. Every extra pound taken from employers is a pound not spent on creating jobs, training staff, or investing in growth. Labour may dress it up as fairness or responsibility, but it’s nothing more than a cash-grab at the expense of working people, who ultimately pay the price when businesses retreat.

Long-term, this pattern poses a serious threat to Britain’s global competitiveness. Labour’s relentless tax-heavy approach discourages risk-taking and entrepreneurship, making the UK a far less attractive environment for ambitious start-ups and expanding firms. Investors and innovators look elsewhere when the cost of employing people and scaling operations is artificially inflated, and the nation loses out on both capital and talent.

The workforce responds in kind. Faced with fewer openings, higher employment costs, and a climate of uncertainty, employees become risk-averse, sticking to familiar roles rather than pursuing new opportunities or advancing their careers. Ambitious individuals are forced to temper their plans or leave for markets that reward initiative rather than penalise it. Opportunities concentrate in a shrinking number of firms willing or able to navigate the cost burden, while the majority of businesses are too cautious to hire, expand, or invest in growth.

Economic growth suffers as a result. The cycle of cautious employers and constrained workers slows innovation, reduces productivity gains, and limits wage growth. Sectors that should be thriving including technology, construction, logistics, and manufacturing, British firms have experienced stagnation whilst firms in the same space globally face high-growth and opportunity. Young people, fresh graduates, and career-changers encounter a bottleneck in the job market, while older workers see fewer avenues for advancement. Communities across the UK feel the effects in delayed housing projects, shuttered high streets, and fewer apprenticeships.

Instead of cultivating a vibrant, opportunity-driven economy that encourages talent, enterprise, and innovation, Labour’s policies have fostered a system dominated by caution. Ambition is muted, risk-taking is punished, and ordinary people who depend on opportunity, fair wages, and job progression bear the weight of a government more focused on extracting revenue than enabling growth. The consequences are long-lasting, shaping the prospects of both today’s workforce and the generations to come.

This is the reality: when government squeezes the private sector, it is the public who pays the price. Fewer hires translate directly into fewer opportunities for young people, families, and workers seeking to progress or retrain. Communities feel it in closed shops, delayed housing, and overstretched services. With another Budget on the horizon, the warning could not be clearer; if this tax-heavy approach continues, Britain risks entrenching itself as the sick man of Europe once more, losing both competitiveness and the chance for sustainable growth.

Every extra levy, every payroll hike, every regulatory burden discourages businesses from expanding, from innovating, and from creating the jobs that ordinary people rely on. The cost is not measured in abstract economic forecasts; it is measured in missed pay rises, stalled careers, and a generation of workers facing fewer pathways to success. Labour’s policies threaten to lock the country into a cycle where opportunity is scarce, ambition is muted, and communities struggle to thrive.

Hard choices have to be made. Britain can continue down a path of heavy-handed taxation and shrinking employment, or it can prioritise growth, enterprise, and opportunity, giving businesses the room to hire, innovate, and invest in the people who keep the economy moving. The stakes are real, and the consequences of inaction will be felt by every worker, every family, and every town across the country.

At the same time, Britain’s borrowing and taxation are at record levels, placing an unprecedented burden on both businesses and households. The government’s reliance on extracting revenue through higher taxes and running ever-larger deficits has created a short-term solution that merely digs a deeper hole for the future. Every pound taken from employers is a pound not invested in growth, innovation, or job creation, and every loan the Treasury takes on adds to the debt that future generations will be forced to repay.

Today’s policies are mortgaging the prosperity of tomorrow. Young people entering the workforce will inherit a country weighed down by debt that will take decades to clear, fewer opportunities, and a stifled economy. Families will face higher taxes and lower services for decades as the cost of today’s overspending and over-taxation is passed down. Labour’s approach treats revenue-raising as a substitute for economic strategy, but taxation and borrowing alone cannot generate growth, productivity, or sustainable employment.

The solution lies elsewhere. Investment into commerce, industry, and innovation is the way to rebuild Britain’s economy. Encouraging entrepreneurship, reducing unnecessary payroll burdens, and enabling businesses to expand will create jobs, raise wages, and stimulate economic activity in a way that borrowing and taxation simply cannot. Productivity gains, rather than more fiscal raids, are what will allow the nation to solve its financial challenges while safeguarding the opportunities and prosperity of future generations.

If Labour continues down the path of punishing employers with record taxes while piling on debt, it is not just today’s workforce that suffers. It is the young people of tomorrow, the communities already struggling to thrive, and the long-term stability of the nation itself that will bear the cost. Britain cannot tax its way out of decline; it must invest in the private sector, nurture opportunity, and allow enterprise to drive recovery.

Every element of Britain’s economy is showing the cost of Labour’s tax-heavy approach. Recruitment has collapsed, leaving fewer opportunities for workers and young people. Job “hugging” has become the norm as employees cling to security in a market where ambition is punished. Key sectors that keep Britain moving including retail, hospitality, construction, agriculture and logistics are all feeling the strain, with businesses freezing hiring, scaling back projects or simply closing down and cutting opportunities for communities across the country.

At the same time, record borrowing and unprecedented taxation are mortgaging the future, leaving younger generations to shoulder the burden of today’s short-term cash grabs. Long-term competitiveness is at risk, as risk-taking, entrepreneurship, and innovation are stifled, and economic growth flattens under the weight of levies and regulatory pressure.

Taxing businesses into the ground does not strengthen the nation; it restricts opportunity, stagnates wages, and undermines communities. Britain cannot hope to escape its current economic challenges through levies and borrowing alone. What is needed is investment, enterprise, and productivity, delivering policies that empower businesses to hire, innovate, and grow.

If Labour continues to punish the private sector, the country will continue to pay the price. Opportunity will shrink, ambition will falter, and the public will bear the cost. Taxation is not a solution, it is the problem, and unless the approach changes, Britain risks cementing itself as an economy trapped by its own government’s policies

References

- Office for Budget Responsibility (2025). The Labour Supply Impacts of Personal Tax Policies. Available at: https://obr.uk/box/the-labour-supply-impacts-of-personal-tax-policies/ (Accessed: 9 September 2025).

- Office for Budget Responsibility (2025). Economic and Fiscal Outlook – March 2025. Available at: https://obr.uk/efo/economic-and-fiscal-outlook-march-2025/ (Accessed: 9 September 2025).

- Organisation for Economic Co-operation and Development (2025). Taxing Wages 2025. Available at: https://www.oecd.org/en/publications/2025/04/taxing-wages-2025_20d1a01d.html (Accessed: 9 September 2025).

- Organisation for Economic Co-operation and Development (2025). Taxing Wages 2025: Brochure. Available at: https://www.oecd.org/content/dam/oecd/en/topics/policy-issues/tax-policy/taxing-wages-brochure.pdf (Accessed: 9 September 2025).

- European Commission (2025). European Economic Forecast – Spring 2025. Available at: https://economy-finance.ec.europa.eu/document/download/e9de23c8-b161-40d0-9ad7-e04a25500023_en?filename=ip318_en.pdf (Accessed: 9 September 2025).

- European Commission (2025). European Commission Presents Annual Report on Taxation. Available at: https://taxation-customs.ec.europa.eu/news/european-commission-presents-annual-report-taxation-2025-06-24_en (Accessed: 9 September 2025).

- Tax Foundation (2025). Tax Burden on Labor in Europe, 2025. Available at: https://taxfoundation.org/data/all/eu/tax-burden-on-labor-europe/ (Accessed: 9 September 2025).

- Tax Foundation (2025). Windfall Profits Taxes in Europe, 2025. Available at: https://taxfoundation.org/data/all/eu/windfall-profits-taxes-europe/ (Accessed: 9 September 2025).

- Tax Foundation (2025). Lowering Labor Taxes Is Essential to EU Competitiveness. Available at: https://www.gisreportsonline.com/r/eu-taxes-labor-europe-competitiveness/ (Accessed: 9 September 2025).

- House of Lords Library (2024). Impact of Tax Policy on Employment. Available at: https://lordslibrary.parliament.uk/impact-of-tax-policy-on-employment/ (Accessed: 9 September 2025).

- Economics Help (2025). How Is the Economy Doing in 2025? – Labour’s First Year. Available at: https://www.economicshelp.org/blog/217635/economics/how-is-the-economy-doing-in-2025-labours-first-year/ (Accessed: 9 September 2025).

- Tax Justice Network (2025). Millionaire Exodus Did Not Occur, Study Reveals. Available at: https://taxjustice.net/press/millionaire-exodus-did-not-occur-study-reveals/ (Accessed: 9 September 2025).

- Office for Budget Responsibility (2025). The Impact of Frozen or Reduced Personal Tax Thresholds. Available at: https://obr.uk/box/the-impact-of-frozen-or-reduced-personal-tax-thresholds/ (Accessed: 9 September 2025).

- OECD (2025). OECD Economic Surveys: European Union and Euro Area. Available at: https://www.oecd.org/en/publications/2025/07/oecd-economic-surveys-european-union-and-euro-area-2025_af6b738a.html (Accessed: 9 September 2025).

- UK Parliament (2025). Taxes – Hansard – UK Parliament. Available at: https://hansard.parliament.uk/commons/2025-07-15/debates/885057BF-B786-4925-8929-0C6CF30825FA/Taxes (Accessed: 9 September 2025).

- Labour Party (2025). Labour’s Fiscal Plan. Available at: https://labour.org.uk/change/labours-fiscal-plan/ (Accessed: 9 September 2025).